What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

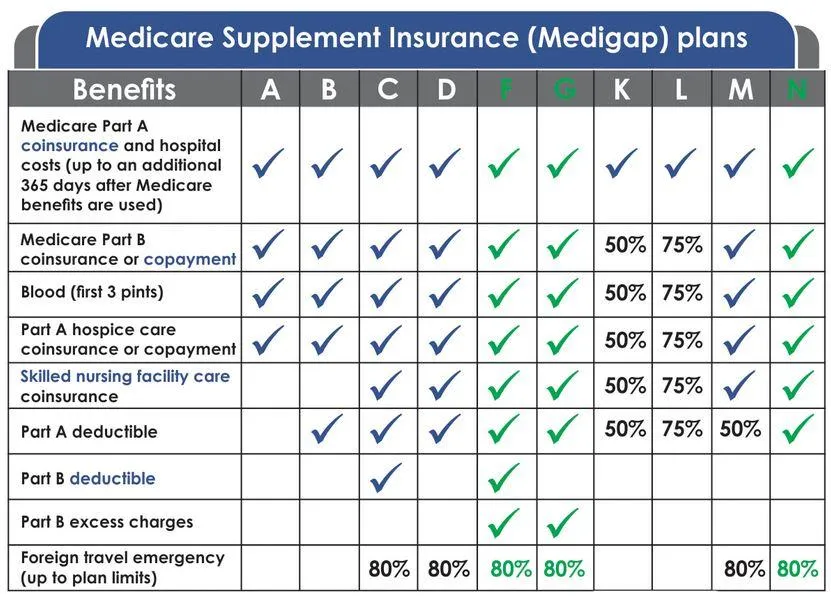

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then your Medicare Supplement plan starts to help with covering costs up to the plan's limit. That limit usually covers what Medicare doesn't. However, that will depend on which Medigap policy you select.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B outpatient expenses. The other 20% comes out of your pocket if you do not have a Medicare Supplement policy. If you were to have an expensive operation at an outpatient facility, for example, you can see how that would add up.

Medicare Supplement plans (also known as Medigap) pay that 20% for you.

Is there anything not covered by Medicare Supplement Plans?

If any service you receive is not covered by Original Medicare (Part A and Part B), then it will not be covered by your Medicare Supplement plan either. Some examples include:

Routine dental, vision, and hearing exams

Hearing aids

Eyeglasses or contacts

Long-term care or custodial care

Retail prescription drugs

Which Medigap Plans Can I Choose From?

Plans that are highlighted in green above are the 3 most popular plans that clients choose when selecting a Medigap/Medicare Supplement plan.

Get a Consultation

& Quote at No Cost

By submitting your information, you acknowledge a licensed insurance agent may contact you by phone, text, email, or mail to discuss and quote Medicare Supplement Plans, Medicare Advantage Plans, and/or Medicare Part D Prescription Drug Plans.

Livingstone Insurance Services Copyright 2023 -- All Rights Reserved -- Privacy Policy

Phone: (888) 551-1954

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800 MEDICARE to get information on all of your options.